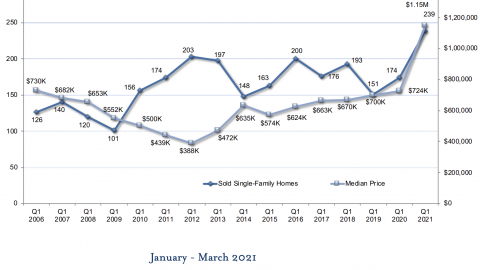

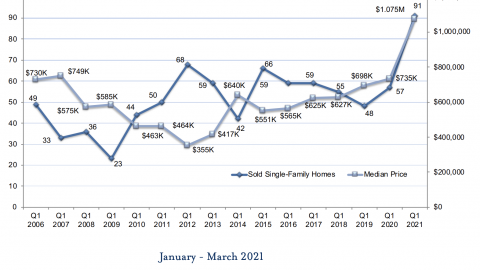

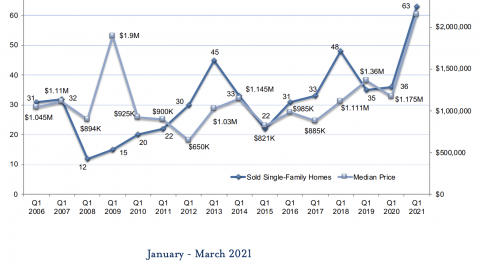

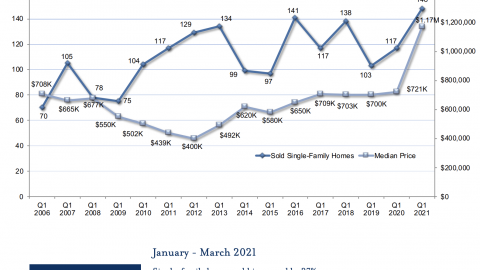

In the first quarter of 2021, we saw the continued impact of the pandemic on Tahoe’s real estate market. As we saw throughout 2020, the appeal of Lake Tahoe, as a convenient escape from urban centers, drove increased demand. The demand continued to exceed supply, triggering a flurry of buying activity that resulted in a spike in median price. All micro-regions, with the exception of lakefronts, saw unprecedented increases in both the number of homes sold and median price, reaching historic highs. The Tahoe Sierra MLS saw a 37% increase in sales volume of single-family homes year over year alongside a 59% increase in median price. Incline Village & Crystal Bay saw a 75% increase in sales volume alongside an 83% increase in median price year over year. For the first time in history, all micro-regions now show the median price of single-family homes over $1M. And, the percentage of homes that sold over $2M reached an all-time high. Seven single-family lakefront homes between Incline Village & Rubicon Bay sold in Q1, a high-mark that was matched in both 2006 and 2014. The median price of lakefronts decreased 33% year over year, however due to the small sample size, that decrease does not directly correlate to market depreciation, supported by the $31M lakefront sale in Q1 noted as the highest California-side lakefront sale in two years and the $31.5M lakefront sale in Incline Village. Given the current pace, it is foreseeable that the market remains strong through 2021, and as COVID threats subside and cities begin to reopen, we may see the state of the market level out in 2022.

Download the detailed report here.

Download past reports here.

View the graphs of sales volume and median price trends by micro-region by clicking the gallery images below.

Source: Tahoe Sierra MLS and Incline Village MLS